Buying a tax deed property can seem like a dream come true—real estate at a fraction of market price. But what exactly is a tax deed property? When a property owner fails to pay their property taxes, the county government has the authority to auction the property to recover the delinquent taxes. This is done through a tax deed sale, where the winning bidder obtains ownership rights to the property, sometimes for pennies on the dollar. It sounds like a win, but the process isn’t always as simple or risk-free as it may seem.

The Appeal of Buying Tax Deed Properties

Many investors are drawn to tax deed properties for one major reason: the potential for high returns. Buying a property for a fraction of its market value and either flipping it or renting it out can lead to significant profit margins. In competitive real estate markets, finding deals like this is rare. With the right research and strategy, a single successful tax deed purchase can be the foundation for long-term financial gains. It’s no wonder this niche of real estate investing is gaining more attention from both seasoned investors and newcomers.

Risks That You Shouldn’t Ignore

Despite the allure, buying tax deed properties carries its share of risks. First and foremost, you’re buying the property “as is.” That means no inspections, no walkthroughs, and no guarantees. The property may have structural issues, mold, code violations, or be occupied by someone who refuses to leave. On top of that, some tax deed properties come with title issues that may require legal action to resolve. These problems don’t make tax deed investing a bad idea, but they do require buyers to be cautious, informed, and prepared.

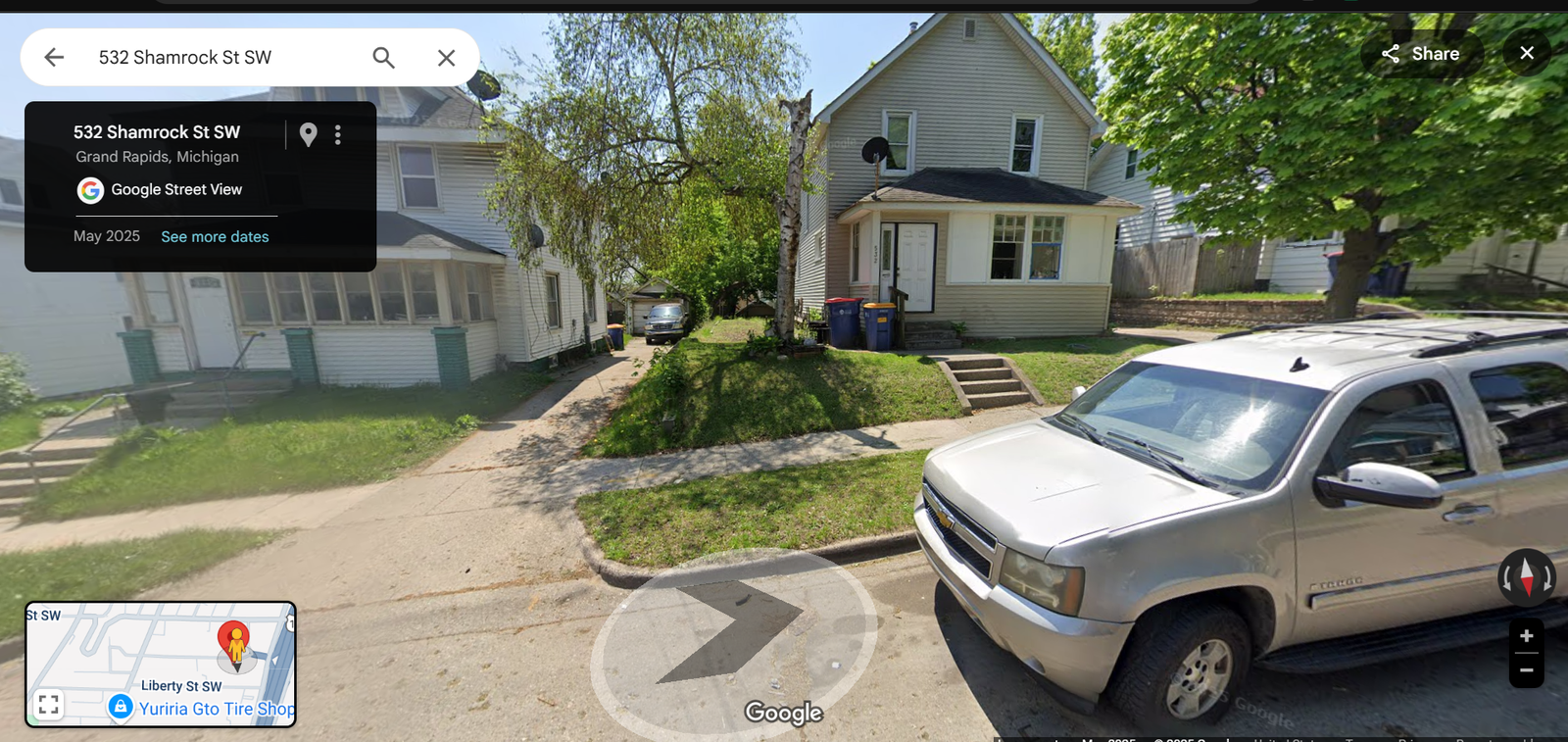

Doing Your Due Diligence Before Bidding

Success in tax deed investing hinges on proper due diligence. Research is your best defense against costly mistakes. This means investigating the property’s location, estimated value, physical condition, and any potential liens or encumbrances. Some counties allow limited property inspections or offer detailed property reports. Use every resource available, including public records and GIS mapping tools, to get the full picture. The better your due diligence, the better your chances of making a sound investment.

Title Issues and the Quiet Title Process

One common misconception is that buying a tax deed property gives you a clear title automatically. While you do gain ownership, the title isn’t always marketable. This means you might struggle to sell or finance the property without first clearing any clouds on the title. That’s where a legal process called a “quiet title action” comes in. This court proceeding confirms your ownership and helps eliminate competing claims. It adds time and cost to the process, but it’s often a necessary step for serious investors who plan to resell or refinance the property.

The Redemption Period and Its Impact on Buyers

Depending on the state, some tax deed properties come with a redemption period. During this time, the original owner can repay their taxes and reclaim the property. If you’ve purchased the property, you may get your money back, but you’ll likely have to wait months—or even years—before taking full control. In other states, redemption occurs before the auction, meaning once you win the bid, the property is yours to manage immediately. Understanding your local laws is key to knowing when and how you can take possession.

Financing Options for Tax Deed Properties

Traditional mortgage lenders are unlikely to finance tax deed purchases, especially since auctions typically require full payment upfront. This makes cash the preferred method of payment. However, some investors use private lenders, partners, or self-directed IRAs to fund their purchases. If you don’t have cash on hand, creative financing might be possible, but you’ll need to plan ahead. Just be sure that whatever funding source you use allows for quick access to capital, as tax deed sales usually have tight deadlines for payment.

Rehabbing and Reselling: What to Expect

If you’re lucky enough to win a tax deed property that’s structurally sound and vacant, you’re ahead of the game. Many buyers choose to rehab the property and resell it for a profit. This can be a lucrative strategy, but it’s important to factor in renovation costs, local market conditions, and potential legal issues. Some investors underestimate the cost of bringing a neglected property up to code, which can quickly eat into profits. The smartest investors are those who not only plan their renovations wisely but also understand the resale potential in their target market.

Rental Potential and Long-Term Investment Strategy

Tax deed properties aren’t just for flippers. Some investors choose to turn their purchases into long-term rentals. If the location is solid and the property can be rehabbed affordably, turning it into a rental can generate passive income for years to come. Additionally, holding the property allows time for appreciation, increasing the return on investment. Long-term rental strategies are especially useful for buyers looking to build a real estate portfolio or achieve financial independence through consistent cash flow.

Navigating Local Laws and Regulations

Every state—and sometimes every county—has its own rules for how tax deed auctions are conducted. Some states offer online auctions, while others require in-person attendance. Some allow competitive bidding, while others use flat-rate systems. There are also legal timelines, redemption periods, and documentation requirements that vary by location. Before participating in any auction, it’s critical to understand the specific laws in the area where you’re buying. Ignorance of the law can cost you more than just your investment.

Partnering with Experienced Investors or Services

If you’re new to tax deed investing, you don’t have to go it alone. Partnering with experienced investors or using professional services like TDHunter can reduce your learning curve and minimize mistakes. These resources offer valuable guidance on finding deals, conducting due diligence, navigating auctions, and managing post-sale requirements. Whether you’re looking for educational content, deal-finding tools, or full-service support, surrounding yourself with the right team can make a significant difference in your success.

Final Thoughts on Whether It’s Worth the Risk

So, is buying a tax deed property worth the risk? The answer depends on your goals, knowledge, and risk tolerance. For well-informed investors who are willing to do their homework, tax deed properties can offer exceptional value and strong returns. However, they’re not for everyone. The process requires time, patience, and a keen eye for detail. If you treat it like a business and not a gamble, the rewards can be substantial. But if you go in blind, the risks could outweigh the benefits.

Join The Discussion