Buying tax deed properties online has become an increasingly popular investment strategy, especially with more counties offering online auctions. The idea of acquiring real estate for pennies on the dollar is hard to resist. Online platforms make the process seem seamless, giving buyers the impression they can score big from the comfort of home. However, like any investment, there are hidden pitfalls. Before you click that “Bid Now” button, it’s essential to understand the full scope of what you’re getting into.

The Illusion of “Too Good to Be True” Prices

The first thing that draws investors to tax deed properties online is the unbelievably low prices. It’s not uncommon to see properties listed at starting bids that are just a fraction of their market value. But what many don’t realize is that those prices often reflect only the amount of back taxes owed—not the true value of the property. Some of these properties come with extensive issues that severely impact their worth. Without doing due diligence, buyers may end up with a parcel of land that’s not suitable for building or even accessing legally.

Incomplete or Inaccurate Property Descriptions

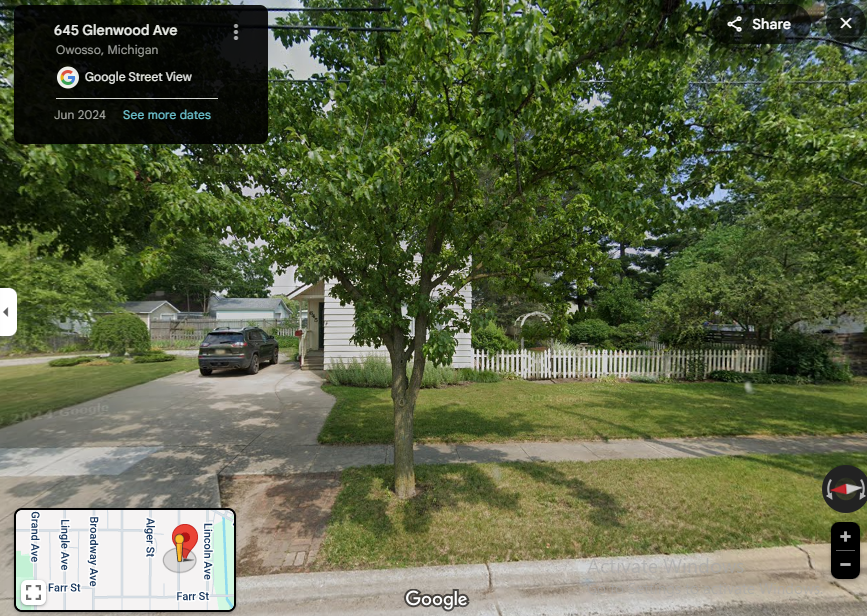

Online tax deed auctions typically offer limited information about the properties up for bid. In many cases, the descriptions provided are minimal, and the photos may be outdated or misleading. While this is often due to legal constraints on what counties can publish, it creates a major blind spot for buyers. You might bid on what you believe is a residential lot only to discover later that it’s a sliver of land with no road access, or worse, it’s underwater. If you’re not doing your own research beyond the auction site, you’re flying blind.

Title Issues That Don’t Go Away With a Deed

Winning a tax deed auction online does not guarantee you a clean title. In most cases, you’re purchasing a property with a “clouded” title, which means that previous liens, judgments, or legal claims may still exist—even after the auction. Some counties offer what’s called a “Treasurer’s Deed” or a “Tax Deed,” but this does not automatically clear the title. To sell or refinance the property in the future, you’ll often need to go through a quiet title action, which can be time-consuming and expensive.

Hidden Liens and Encumbrances Can Haunt You

Many new investors assume that tax deed properties are free and clear once purchased at auction, but that’s not always the case. Some liens—such as IRS liens, municipal fines, or utility bills—may survive the tax sale. If you’re not diligent in your pre-auction research, you could be inheriting someone else’s debt. These obligations won’t just go away because you now hold the deed. Depending on the jurisdiction, you may be fully responsible for resolving these issues before you can make any use of the property.

You May Be Bidding Against Professionals With an Edge

While online tax deed auctions offer accessibility, they also attract professional investors with deep pockets and years of experience. These investors often have teams doing detailed property evaluations, driving to sites, running title searches, and consulting legal experts. If you’re going in alone, especially as a first-time buyer, you’re at a disadvantage. It’s easy to get outbid, or worse, to win a bid on a property that professionals avoided for good reason. The convenience of online bidding doesn’t replace the need for smart strategy and preparation.

Local Rules Vary—and They Matter a Lot

Each county and state has its own set of rules governing tax deed sales. From redemption periods to auction procedures to transfer timelines, these regulations can vary wildly. For example, some states allow previous owners a redemption period even after the auction, giving them the right to reclaim the property under certain conditions. If you’re not familiar with these laws, you could be making a purchase that seems final, only to find out later that it’s not. Understanding the local legal landscape is crucial before making a move.

The Risk of Post-Auction Regret Is Real

Perhaps one of the most overlooked risks of buying tax deed properties online is the emotional toll and financial setback of buyer’s remorse. Investors often make quick decisions under pressure during online auctions. You might bid more than planned or act on limited information, only to find later that the property is unusable or requires extensive legal work. Unlike retail purchases, there are no refunds or do-overs in most tax deed auctions. Once you win, you’re committed—whether it’s a great deal or a major headache.

Final Thoughts: Do Your Homework or Pay the Price

Buying tax deed properties online offers an exciting opportunity, but it’s not a shortcut to wealth. The risks are real, and they can be costly. From legal complexities to misleading listings and unexpected competition, there’s a lot to consider before jumping in. The good news? With the right tools, research, and a clear understanding of the process, it’s possible to navigate these challenges successfully.

If you’re serious about investing in tax deed properties, take the time to learn the process, understand your local laws, and seek out resources—like TDHunter.com—that can help guide your journey. Armed with knowledge and a healthy dose of caution, you can turn risk into reward and avoid the common traps that catch so many new investors off guard.

Join The Discussion